- RiskReversal Recap

- Posts

- RiskReversal Recap: July 18, 2024

RiskReversal Recap: July 18, 2024

Market Sell-Off Accelerates

MARKET WRAP

The sell-off intensified today, with the decline broadening beyond tech stocks.

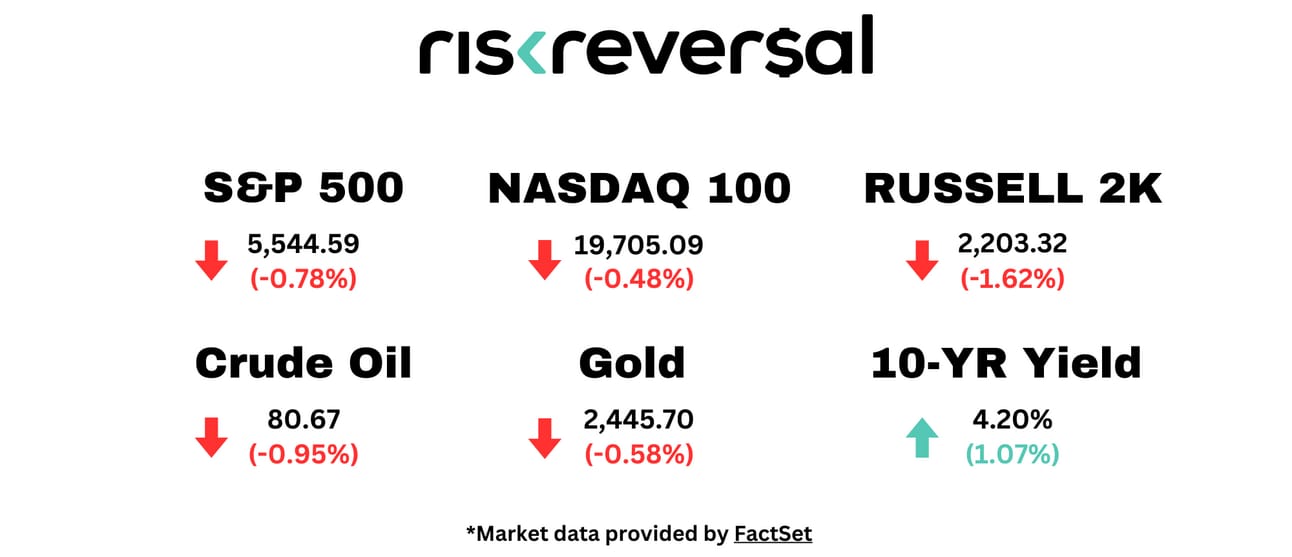

The S&P 500 fell 0.78%, while the Nasdaq fell 0.7% and the Russell 2000 was down nearly 2%.

This comes after a surge in jobless claims showed the labor market continues to cool, offsetting excitement over a September rate cut.

The market-wide retreat signals a potential pause in the recent bull run.

DR Horton shares surged 10% to an all-time high after the company beat on earnings. Rivals Pultegroup and Toll Brothers also touched new highs, rallying more than 2% each.

According to CNBC, by midday, at least 69 stocks in the S&P 500 had reached new 52-week highs. Names like Coca-Cola, UnitedHealth, WalMart, BlackRock, and Lockheed Martin made the list.

On the contrary, Las Vegas Sands and Estee Lauder hit new 52-week lows.

Of the Mag 7 stocks, Nvidia and Meta caught a rebound, up around 3%. Meanwhile, declines in Amazon, Alphabet, Microsoft, and Apple continued to accelerate.

MRKT MATRIX: July 18, 2024

Today’s Top Stories:

Dow tumbles 500 points, S&P 500 slides 1% as broad sell-off intensifies(CNBC)

Wall Street’s ‘Great Rotation Trade’ Takes a Break

Goldman’s Top Stock Analyst Is Waiting for AI Bubble to Burst (Bloomberg)

Eli Lilly’s stock plunges as investors eye obesity-drug competition(MarketWatch)

Domino's Stock Sinks After Pizza Chain Warns of Fewer Store Openings (WSJ)

Amazon Prime Day boosts US online sales to record $14.2 bln, Adobe says (Reuters)

Ford to spend $3 billion to expand large truck production to a plant previously set for EVs(CNBC)

OpenAI Has Talked to Broadcom About Developing New AI Chip(The Information)

Behind the Curtain: Top Dems now believe Biden will exit (Axios)

Subscribe to the RiskReversal YouTube Channel and drop a comment/like to show your support

Want to check out past podcast episodes? Go to wherever you get your podcasts and type in “RiskReversal Media”

We want to hear your feedback! Reply to this email with any comments or questions