- RiskReversal Recap

- Posts

- Tesla Reports Earnings

Tesla Reports Earnings

RiskReversal Recap: October 23, 2024

MARKET WRAP

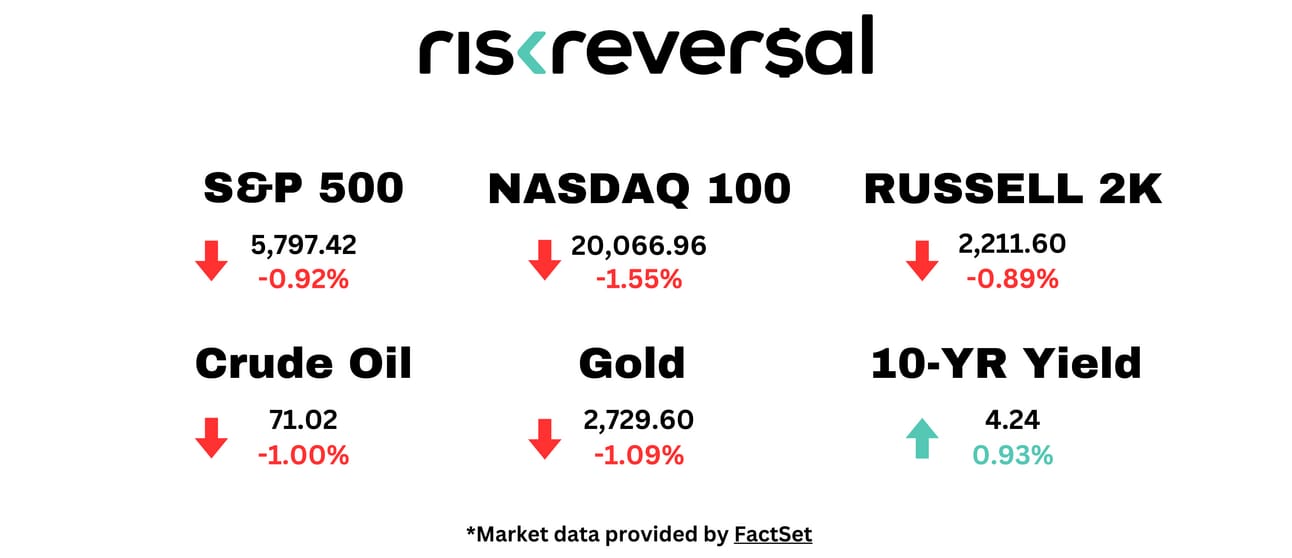

Stocks dropped today as higher yields weigh on market sentiment.

The Dow fell more than 400 points for its worst day in over a month. The S&P 500 was down 0.92%, while the Nasdaq was down 1.6% and the Russell 2000 fell 0.91%.

At session highs, the yield on the U.S. 10-year was above 4.25%.

Consumer discretionary was the worst-performing sector, down more than 1.5%. Real Estate and Utilities were higher on the day.

All of the Mag 7 stocks were under pressure today. Meta fell 3.15%, Nvidia was down 2.81% and Amazon down 2.63%.

Tesla reported earnings after the close. The company had a solid beat on earnings, but missed slightly on revenue. Shares were up immediately after the report.

MRKT MATRIX: October 23, 2024

Today’s Top Stories:

Dow drops more than 400 points, heads for worst day in over a month (CNBC)

Stocks to Watch Wednesday: McDonald's, Starbucks, AT&T, Coca-Cola (WSJ)

Baird downgrades McDonald’s after E. coli outbreak (CNBC)

Frontier, Spirit Airlines Revive Merger Talks (WSJ)

Apple releases new preview of its AI, including ChatGPT integration (CNBC)

Apple analyst Kuo says company cut iPhone 16 orders by 10 million units (CNBC)

Nvidia Chief Makes Case for AI-First Companies (WSJ)

Amazon-backed Anthropic debuts AI agents that can do complex tasks, racing against OpenAI, Microsoft and Google (CNBC)

JPM Securities upgrades Snap amid app revamp, says shares can rally 70% (CNBC)

Bank of America CEO Urges Fed to Not Go Too Hard on Rates (Bloomberg)

September home sales drop to lowest level since 2010 (CNBC)

Today’s MRKT Call is Presented by SoFi

Consumer Stocks Slump: McDonald's, Starbucks, Apple

Dan Nathan, Guy Adami and Liz Young Thomas break down the top market headlines and bring you stock market trade ideas for Wednesday, October 23rd.

Click here to access all of the charts mentioned in today’s MRKT Call.

Sign up below to receive daily MRKT Call reminders and early access to the charts featured in the show.

Dan Ives on the Many Lives of AI

Dan Nathan is joined by tech analyst Dan Ives from Wedbush Securities. The conversation revisits their initial discussion from March 2023 on upcoming tech disruptions, examining changes from the dot-com bubble to present-day market players. Key topics include the evolution of tech stocks and the crucial role of long-term investments, along with critical insights into AI's ongoing transformation and its impact across sectors like energy, semiconductors, software, and cybersecurity. Tesla's market strategy and challenges, Apple's AI potential, and broader economic implications for tech giants like Google and Meta are also explored. The episode dives deep into the risks associated with Q3 earnings, focusing on market sentiment, CapEx trends, and strategic maneuvers of major tech firms. Political implications, including potential impacts of a Trump re-election on tariffs and tech, are discussed, underlining the complex interplay of regulatory pressures and market dynamics.

Subscribe to the RiskReversal YouTube Channel and drop a comment/like to show your support

Want to check out past episodes? Search for “On The Tape,” “MRKT Call,” or “Okay, Computer.” wherever you listen to podcasts

We want to hear your feedback! Reply to this email with any comments or questions